The Future of the Dollar in a Digital Financial Landscape

The use of digital currency has been a hot topic of discussion in recent years. With the rise of cryptocurrencies like Bitcoin and Ethereum, many have expressed their concerns over the future of traditional, sovereign currency. While some believe that the government's shift to digital currency will ultimately lead to a collapse of the dollar, others see it as an opportunity to enhance the financial system and provide greater security and control. In this article, we will explore the future of sovereign currency and cryptocurrency, and the role that government plays in determining the success or failure of these digital assets.

Sovereign Currency at the Core of a Well-Functioning Financial System

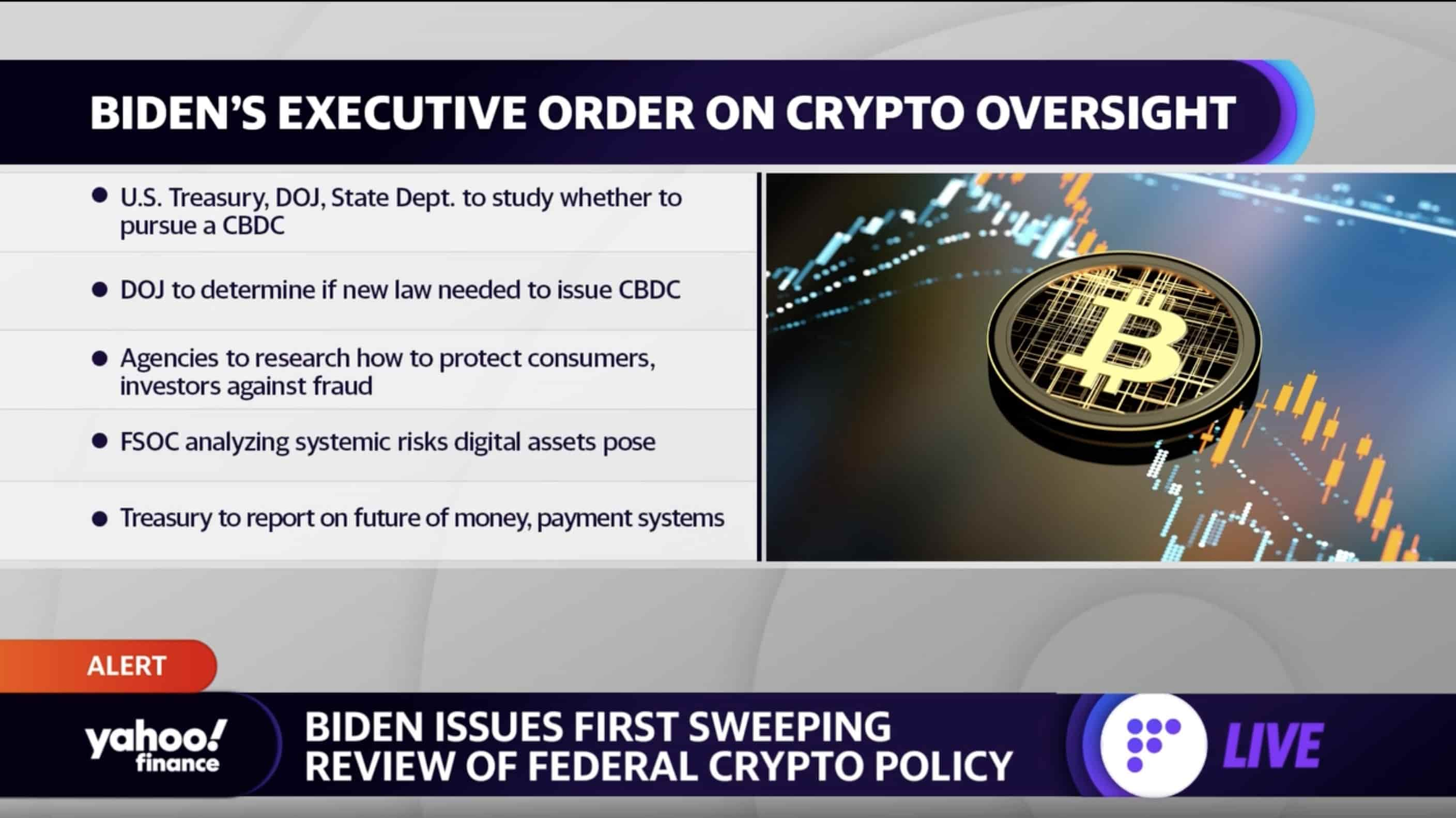

Sovereign money is at the core of a well-functioning financial system and is essential for macroeconomic stabilization policies and economic growth. Governments have long held a monopoly on the creation of money, and this power is not likely to be surrendered any time soon. The recent Executive Order 14067 signed by President Biden highlights the urgency that the administration places on research and development efforts into the potential design and deployment options of a United States CBDC.

Leadership and Participation in International Fora

In addition to exploring the potential benefits of a United States CBDC, the Biden administration has also expressed interest in showcasing American leadership and participation in international discussions and pilot projects involving CBDCs. This shows a recognition of the growing importance of digital currencies in the global financial landscape and a willingness to stay ahead of the curve.

The Bank of England's Proposed Programmable Digital Currency

In 2021, the Bank of England proposed that UK digital currency should be programmable. This means that, for example, a parent could block their child from spending money on candy. If a parent can do that, then the government could do it on a much larger scale.

The Government's Monopoly on Money Creation

The power to create money has been monopolized by governments for thousands of years, and it is unlikely that they will surrender that power. While cryptocurrencies are currently allowed to exist, there are some concerns that the government is only letting the private sector promote them so that they can eventually confiscate them all.

Despite this, the idea of a crash in the value of the US dollar is still being discussed by some people. They believe that when the government converts the dollar to a digital form, it will function like spyware, tracking everything that people do. Biden’s Executive Order 14067 has been cited as evidence of this potential crash, but if you read the order carefully, you will see that the government has no intention of allowing cryptocurrencies to compete with the sovereign currency.

Sovereign money is essential for a well-functioning financial system, macroeconomic stabilization policies, and economic growth. Biden’s administration has placed a high priority on researching and developing options for a United States central bank digital currency (CBDC). The administration also recognizes the value of showcasing US leadership in international forums related to CBDCs and participating in multi-country conversations and pilot projects involving CBDCs.

Conclusion

In conclusion, while the idea of a crash in the value of the US dollar due to the government's move to a digital currency is a concern for some, the government's monopoly on money creation and its focus on developing a sovereign digital currency suggest otherwise.